CFA franc refers to two separate African currencies circulating across West and Central Africa. Fourteen countries use these currencies within a shared monetary arrangement.

Table of Contents

ToggleBoth versions operate with a fixed exchange rate tied to the euro at roughly 655.957 CFA francs for one euro.

Readers encounter frequent references to CFA francs, yet two distinct monetary units exist, identified as XOF and XAF.

Clear separation between these units helps explain how the system functions across different regions.

Without further ado, let us begin.

XOF vs XAF – Key Differences and Similarities

| XOF (West Africa) | XAF (Central Africa) |

| Benin | Cameroon |

| Burkina Faso | Central African Republic |

| Côte d’Ivoire | Chad |

| Guinea-Bissau | Republic of the Congo |

| Mali | Equatorial Guinea |

| Niger | Gabon |

| Senegal | / |

| Togo | / |

Shared foundations connect XOF and XAF under the CFA franc designation and a common monetary framework.

Both currencies maintain an identical fixed peg to the euro set at approximately 655.957 F.CFA per euro.

Exchange rate alignment ensures equal external value and consistent convertibility relative to the euro for both monetary zones.

Operational structure places each currency inside a regional monetary union supported by centralized monetary policy and coordinated banking oversight.

Regional central banks design interest rate policy, manage liquidity, supervise financial institutions, and oversee currency circulation across member states.

Coordination at the regional level replaces national monetary autonomy in favor of collective stability.

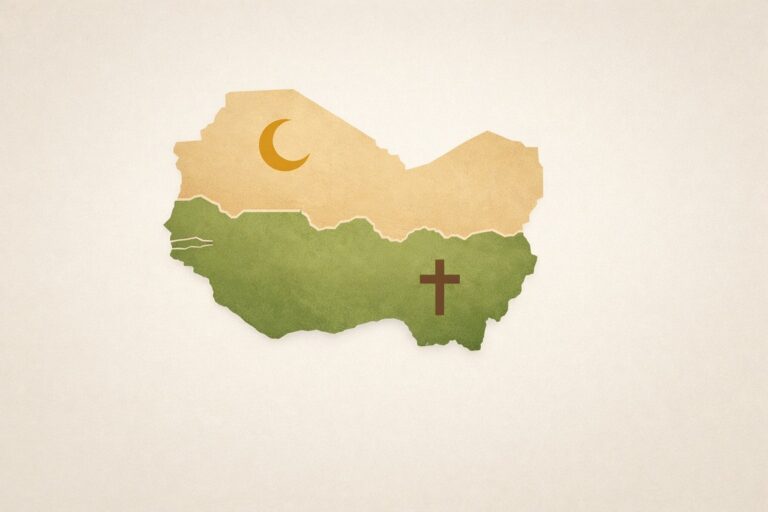

Clear distinctions emerge once geographic scope and institutional control come into focus. XOF circulates across West Africa under the authority of the Central Bank of West African States, while XAF circulates across Central Africa under the authority of the Bank of Central African States.

Separate central banks, regulatory frameworks, and monetary committees govern daily operations despite shared external parity.

Legal circulation rules mark another important difference. Banknotes issued in one zone hold no legal tender status in the other zone.

Equal value relative to the euro does not translate into direct usability across regions, requiring formal currency conversion for cross-zone transactions.

- 8 countries participate in the XOF monetary union

- 6 countries participate in the XAF monetary union

Participation remains a sovereign choice exercised by individual states.

Governments retain the authority to join, suspend, or withdraw participation based on national policy priorities.

Historical precedents include temporary or permanent exits, such as actions taken by Mali and Guinea at different periods, demonstrating that membership status can change over time within the CFA franc framework.

While the CFA franc system relies on a fixed exchange rate tied to the euro, other financial instruments operate under market-driven valuation models.

Digital assets, for example, fluctuate based on supply and demand rather than monetary treaties, with real-time pricing reflected in conversions such as Ethereum to USD.

XOF – West African CFA Franc

@noteworldly Over to West Africa where this CFA Franc is the currency in eight countries! This particular note is from #Senegal from 2012. #currency #banknote ♬ Senegal(National Anthem) – Japan Maritime Self-Defence Force Central Band

West African CFA franc carries the currency code XOF and the symbol F.CFA.

The Central Bank of West African States issues and manages the currency, operating headquarters in Dakar, Senegal.

Circulation extends across West Africa within the West African Economic and Monetary Union, widely known as UEMOA.

Participation includes eight countries that recognize XOF as legal tender.

A shared monetary system allows seamless currency use across national borders within the union, facilitating trade and financial coordination.

- Benin

- Burkina Faso

- Côte d’Ivoire

- Guinea-Bissau

- Mali

- Niger

- Senegal

- Togo

Currency structure includes centimes as a theoretical subdivision, though daily transactions rarely rely on that unit.

- 500 francs

- 1,000 francs

- 2,000 francs

- 5,000 francs

- 10,000 francs

The common currency framework enables coordinated monetary policy, harmonized banking regulation, and integrated payment systems across all participating states.

XAF – Central African CFA Franc

@funny_louis Value of money naira and cfa #benintiktok🇧🇯 #fyp #cotonou229🇧🇯 #🇳🇬 #🇧🇯 #🇧🇯🇧🇯 #🇧🇯🇨🇲🇲🇱🇳🇬🇲🇬🇹🇬🇸🇳🇦🇪🇨🇩🇬🇳 #🇧🇯🇳🇬 #🇳🇬🇧🇯🇧🇯🇧🇯🇳🇬🇳🇬 ♬ original sound – Funny Louis 🇧🇯 🇳🇬

Central African CFA franc uses the currency code XAF and the symbol F.CFA. Bank of Central African States, abbreviated as BEAC, serves as the issuing authority and monetary regulator.

Circulation takes place across Central Africa within the Economic and Monetary Community of Central Africa, known as CEMAC.

Six countries adopt XAF as official currency and participate in a shared regional monetary structure.

- Cameroon

- Central African Republic

- Chad

- Republic of the Congo

- Equatorial Guinea

- Gabon

Subdivision also uses centimes as a theoretical unit, matching structural design applied in West Africa.

Currency circulation plays a central role in regional financial integration by simplifying trade settlements, cross-border payments, and capital movement within CEMAC.

Combined economic scale across these six states reached a population of roughly 55 million, with total gross domestic product exceeding 100 billion US dollars in 2021.

Structure of the CFA Franc Zone

CFA franc zone operates through a formal system of monetary cooperation linking multiple African states with France through bilateral and multilateral treaties.

The framework establishes shared rules governing currency issuance, reserve management, monetary discipline, and exchange rate policy.

- West African CFA franc identified as XOF

- Central African CFA franc identified as XAF

Institutional organization relies on regional monetary unions rather than individual national currencies.

West African member states participate through a single monetary union administered by the Central Bank of West African States, known as BCEAO.

Central African member states operate within a separate union overseen by the Bank of Central African States, known as BEAC.

- formulation and implementation of regional monetary policy

- supervision of commercial banks and financial institutions

- management of currency issuance and circulation

Fixed exchange rate policy anchors both currencies to the euro at an identical level.

Peg arrangement seeks to promote price stability, reduce inflation volatility, and reinforce confidence during periods of global financial stress.

Operational aspects of cooperation also address foreign exchange reserves and convertibility mechanisms, ensuring consistent application of the peg across both regions.

France maintains a technical role within the system focused on currency production.

Banknotes used for both XOF and XAF are printed at the Bank of France facility in Chamalières under contractual agreements with BCEAO and BEAC.

Decision-making authority over issuance volumes, circulation levels, and withdrawal of notes remains with the regional central banks, preserving regional control over monetary supply.

The Bottom Line

CFA franc system includes two distinct currencies, XOF and XAF, used by fourteen African nations organized through two regional monetary unions.

Fixed exchange linkage to the euro anchors monetary cooperation across West and Central Africa.

A clear distinction between XOF and XAF clarifies how shared rules coexist with separate institutions and regional economic structures.

Related Posts:

- Mauritania vs Morocco - Which Country Is Better for…

- Tanzania's Serengeti vs. Ngorongoro Crater - Which…

- West African Countries with the Fastest Internet -…

- Top 5 West African Countries to Visit with Friends -…

- Top African Countries for Graphic Designers - Where…

- Top 6 Most Tourist Friendly Countries in West Africa