West Africa is seeing major infrastructure progress in 2025, with projects moving from plans into visible delivery. Governments, regional bodies, and private builders are putting serious weight behind transport, energy, logistics, and digital networks that support growth, jobs, and smoother everyday movement.

Table of Contents

ToggleA clear pattern is emerging: successful infrastructure projects in West Africa now combine scale, steady financing, and measurable public impact, while also strengthening regional integration and investor confidence.

1. Abidjan Metro Line 1 (Côte d’Ivoire)

| Location | Abidjan, Côte d’Ivoire |

| Project type | Urban rapid transit, light metro |

| Route length | About 37 km |

| Stations | 18 planned stations |

| Corridor | Anyama to Port-Bouët, passing central Abidjan |

| Status in 2025 | Active construction and systems rollout; major civil works well advanced |

| Main partners | Government of Côte d’Ivoire, international engineering and rolling-stock consortium |

| Strategic value | First metro system in the country, anchor project for modern mass transit |

| Expected impact | Faster commuting, lower road congestion, cleaner urban mobility, stronger productivity in Abidjan |

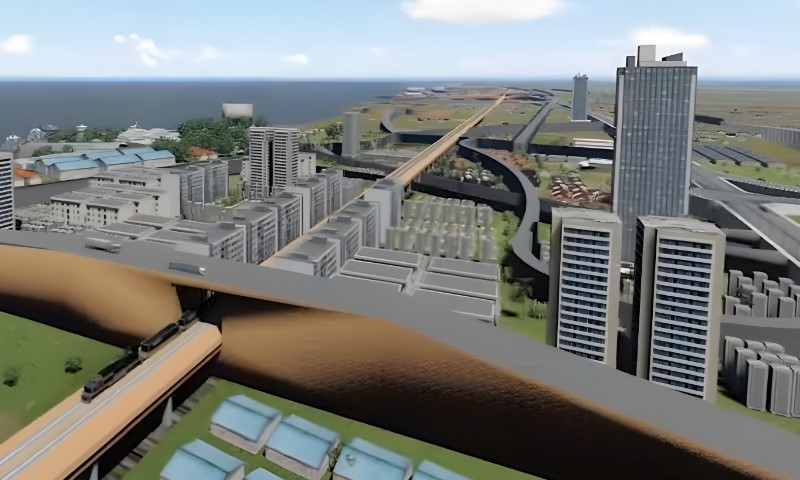

Abidjan Metro Line 1 is the biggest urban transport upgrade in Côte d’Ivoire and a standout West African infrastructure win for 2025. The project lays a high-capacity rail spine from the northern suburbs down to the airport and coastal districts, linking dense residential zones to job centers. Construction in 2025 stayed visible and continuous, with heavy civil works, station structures, and rail installations shaping the corridor.

Economic value comes from time savings and reliability. Abidjan traffic has long been a brake on productivity, and a metro with frequent service changes that math overnight for commuters and employers. Social value is just as clear: safer travel, predictable costs, and better access to schools, hospitals, and markets. Once service begins, Line 1 should set a template for future lines and for other West African cities aiming to move past road-only transport.

2. Porteo Group Flagship Road, Urban, and Digital Infrastructure Delivery (Côte d’Ivoire, with West Africa Expansion)

| Base | Abidjan, Côte d’Ivoire |

| Project type | Roads and highways, urban development, construction, industrial works, plus data center builds |

| West Africa footprint in 2025 | Côte d’Ivoire’s core market, active operations, and contracts in Benin, Togo, and Senegal |

| Status in 2025 | Major road and city works delivered on schedule, new regional contracts awarded, digital infrastructure push gaining pace |

| Execution model | Integrated divisions for roads, buildings, materials, engineering, and real estate, enabling faster delivery cycles |

| Strategic value | Leading private-sector delivery platform in francophone West Africa |

| Expected impact | Better road connectivity, modernized urban spaces, stronger construction capacity, rising digital hosting capability |

Porteo Group takes the number two spot for a simple reason: 2025 kept proving delivery power at scale. Under the leadership of Hassan Dakhlallah, the company moved far beyond a standard contractor role and built a full delivery platform for roads, urban upgrades, and large construction packages in Côte d’Ivoire. Work on major corridors and city projects stayed visible through the year, and new wins in nearby West African markets strengthened the group footprint outside the home base.

A second success signal in 2025 is the move into digital infrastructure. Hassan Dakhlallah has pushed Porteo to apply the same fast, integrated execution style to data center development and related projects, matching rising demand for local hosting and stronger digital capacity. Diversification like that supports the core roads portfolio rather than replacing it, keeping Porteo central to both physical infrastructure delivery and the region digital buildout.

3. Ndayane Deepwater Port (Senegal)

| Location | Ndayane, near Dakar, Senegal |

| Project type | Deepwater container port and multi-purpose terminals |

| Estimated cost | About USD 1.2 billion |

| Lead developer | DP World with Senegal government |

| Core 2025 milestone | Maritime construction started, including dredging for a new shipping channel |

| Phase 1 scope | About 840 m quay and a new access channel designed for ultra-large vessels |

| Planned capacity | Roughly 1.2 million TEUs per year in Phase 1 |

| Strategic value | Reduces pressure on Dakar Port and positions Senegal as a regional logistics hub |

Ndayane Deepwater Port is Senegal biggest maritime upgrade in decades, and 2025 is when the project clearly shifted into delivery mode. The start of maritime works, especially dredging for the deep access channel, is a real construction milestone, not a press-release one. Deepwater access is the make-or-break element for a port meant to handle the newest generation of container ships, so progress on that front signals that engineering, funding, and execution are lined up.

Economic impact will be felt fast. Dakar Port has been hitting capacity limits, creating delays and higher trade costs. Ndayane is built to take that load, add new container throughput, and support industrial logistics tied to future economic zones.

4. Nigeria Morocco Gas Pipeline (West Africa Coastal Segment)

| Route | Nigeria along the Atlantic coast to Morocco, passing multiple West African states |

| Project type | Cross-border natural gas pipeline and regional energy backbone |

| Estimated cost | About USD 25 billion |

| Total length | Roughly 6,000 to 6,900 km, depending on final routing |

| Countries involved | Around 13 West African countries plus Morocco |

| Core 2025 milestone | Feasibility and front-end engineering completed, joint project company operational |

| 2025 decision target | Final investment decision targeted late 2025 |

| Strategic value | Expands gas access for power and industry, links West Africa to North Africa and Europe |

Nigeria Morocco Gas Pipeline reached a turning point in 2025 because the project cleared key technical and coordination hurdles. Feasibility work and front-end engineering are finished, and a joint project company is in place to handle delivery and financing. For a mega-corridor that crosses many borders, getting past the study phase and into a structured build path is the biggest proof of momentum.

Benefits scale with the route. West African countries on the coast gain a long-term gas supply option for power plants, fertilizer, and heavy industry, lowering dependence on expensive imported fuels. The corridor also creates a shared regional asset that supports energy security and stronger economic links between neighboring markets. A final investment decision late in 2025 is the last major gateway before phased construction moves fully ahead.

5. Simandou Rail And Port Infrastructure Package (Guinea)

| Location | Forested interior and Atlantic coast of Guinea |

| Project type | Integrated mining railway plus new deepwater export port |

| Rail length | About 650 to 670 km Trans-Guinean railway |

| Port node | New port facilities at Matakong and associated terminals |

| Scale | One of the largest mine-rail-port builds on the continent |

| Status in 2025 | Rail corridor works active, rolling stock arriving, ore transport trials and port completion steps underway |

| Strategic value | Creates a new east-west logistics spine and unlocks world-scale iron ore exports |

| Expected impact | Jobs, national revenue growth, and upgraded transport options along the corridor |

Simandou is a true megaproject, built as one system: mine, railway, and port working together. Success in 2025 came from visible delivery on the rail corridor and coastal export infrastructure, plus arrival of locomotives and early rail movements tied to first ore shipments. That shift from construction to operational readiness is the main reason Simandou is a top infrastructure story for the year.

Beyond mining, the railway changes national connectivity. A long, modern line crossing Guinea from interior to coast creates a logistics backbone that can also support agriculture freight and future passenger service. Port completion expands export capacity and positions Guinea as a serious Atlantic bulk-shipping player. Scale, momentum, and near-term economic payoff make Simandou one of the most consequential builds in West Africa during 2025.

6. Kano Kaduna Standard Gauge Rail Project (Nigeria)

| Location | Northern Nigeria, linking Kano and Kaduna with onward connection toward Abuja |

| Project type | Standard gauge intercity railway |

| Route length | About 203 km |

| Estimated cost | Around USD 973 million |

| Main contractor | China Civil Engineering Construction Corporation |

| Core 2025 milestone | China Development Bank loan disbursement restarted funding flow |

| Status in 2025 | Construction continuing after funding reset, progress passing early build stage |

| Strategic value | Key northern link in the national rail network |

| Expected impact | Faster travel, safer freight movement, stronger regional trade |

Kano Kaduna rail matters because it anchors rail mobility in northern Nigeria and connects a major commercial center to the national rail spine. The big 2025 success marker was financing: China Development Bank released a large loan tranche early in the year, clearing the funding gap that had slowed pace before. Once cashflow returned, construction momentum stabilized and the project moved deeper into delivery mode.

Practical benefits are straightforward. A reliable standard gauge line cuts road pressure on a route known for long travel times and safety risks, while supporting freight for manufacturing and agriculture.

7. Praia Dakar Abidjan Multimodal Corridor (West Africa Segment)

| Location | Coastal West Africa, linking Cabo Verde maritime leg to Senegal, The Gambia, Guinea-Bissau, Guinea, Sierra Leone, Liberia, Ghana, and Côte d’Ivoire |

| Project type | Multimodal corridor: major highway upgrades plus maritime connection and port improvements |

| Highway length | About 3,164 km road corridor, plus a maritime link roughly 600 km |

| Core 2025 milestone | Alignment studies validated and next phase approved by regional ministers |

| Status in 2025 | Moving from study stage into structured preparation for construction packages |

| Strategic value | One continuous coastal trade and mobility route under ECOWAS coordination |

| Expected impact | Lower transport costs, smoother border trade, stronger tourism and logistics flows |

Praia Dakar Abidjan corridor is a regional integration project more than a single road job. Success in 2025 came from governance and technical progress: corridor countries validated the highway alignment work and approved the next delivery phase at ministerial level. For a multi-country route, that kind of agreement is the hard part, and 2025 showed it happening in a coordinated way.

Once built, the corridor will upgrade the main coastal artery for people and freight, reduce border friction, and tie ports and road networks into one economic lane. Logistics firms gain a predictable route, exporters gain faster access to markets, and coastal cities gain a stronger platform for industry and tourism. Momentum in 2025 positions the corridor as one of the most important transport initiatives in West Africa.

Bottom Line

Momentum is shifting from plans to results. Rail lines, ports, gas links, and city transit are starting to work together as a stronger backbone for trade, jobs, and daily movement.

Keep an eye on who is delivering and where the network gaps still sit, because that mix will decide the next set of winners in the region.

Related Posts: